Plaintiff’s Guide to Litigation Funding

Cashflow can get tight, especially during the current pandemic. COVID-19 is causing trials to be suspended and creating a rift in the traditional way trial preparation is conducted. This can lead to rushing to settle cases to keep cash flowing. However, this is not the only way to get cash flow. You should not avoid trial or take a settlement that is substantially less than what your case is worth just because of the current health crisis. That is bad business acumen for both you and your client. Litigation

funding of lawsuits can bridge the gap between your last payday and the next one. Litigation Finance Funds is a practical option to make sure you get the financial support you need to get the best results for your case and your client. It is also more openly available than many attorneys may think.

What is Litigation Funding?

Litigation funding can be broadly described as an advance of cash for a plaintiff or their attorneys where they gain funding against the plaintiff’s expected award or the attorney’s commercial litigation finance legal fee funding. Basically, it is money in advance in exchange for a share of the proceeds recovered from the resolution of the dispute. The financing company is often called the third-party funding/financing company. Litigation funding is low-risk for both the funding company and the individual or organization being funded. Those being funding agreement simply have to pay the interest accrued plus the initial advance.

How Does It Differ From Other Forms of Financing?

Litigation funding is not a loan, it is an advance of cash that is contingent upon the case outcome. The contingency is the differentiating component of litigation funding. Paying back the funding is completely contingent on winning the case. This means that if the plaintiff receives funding and loses, they do not repay the money that was advanced to them by the third-party funding firm. This type of funding is called non-recourse. Additionally, Commercial litigation funding companies are case specialists who understand the merits of a case and base their funding upon that. Banks and other financial institutions do not have the experience or expertise to understand the claims of a legal case or ability of the litigation counsel. These institutions view this type of funding as too risky and require considerable guarantees and collateral compared to litigation financing companies. With non-recourse litigation funding industry, there is no need for credit checks or collateral. Litigation funding companies do not care about your past financial borrowing or whether you have previous loans, instead, these companies look at your application solely on the merit of the case. They want to ensure that your case is strong and that they will likely get their invested money back, plus interest of course.

Why is Litigation Funding Important Now?

COVID-19 has left many businesses, including law firm, short on cash. Many plaintiff firms are already contingency-based, meaning they only get paid if they win after long legal claim battles. This means that they already struggle with consistent cashflow. With many trials being pushed back until late 2020 or even 2021, cash flow for these companies has come to a screeching halt. Without working capital and scheduled income from their sure-fire cases, firms are struggling. They must adapt to this economic downturn. To bridge the gap between the start of COVID-19 and their next payday, many plaintiff attorney funding firms are turning to third-party litigation funding companies. These companies can give cash advances for your low-risk cases. These cash advances can help pay for pre-litigation research, focus groups, witnesses, and other services necessary to increase your odds of winning your case when court resumes. These cash advances can also be used for day-to-day needs like business operations and even new software and technology, which may be needed as we adjust to this new normal.

Benefits of Litigation Funding

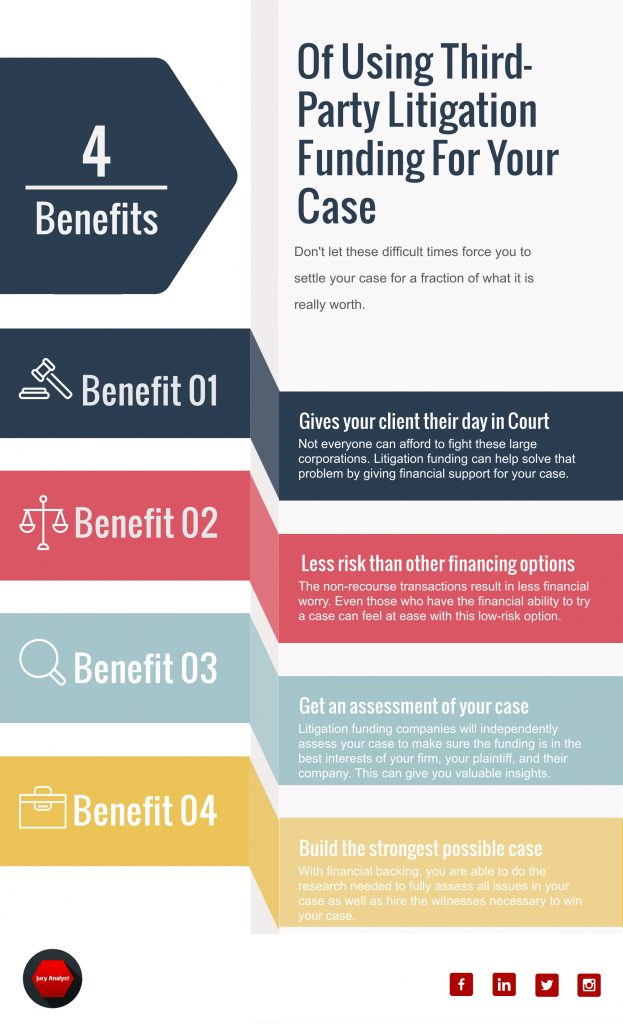

Giving your client their day in court

Not everyone can afford to fight large corporations. When going up against a large corporation or entity, it can feel like David vs Goliath. These corporations can have endless pocketbooks and armies of attorneys, while your firm may only have a handful of staff members and be completely contingency-based. It just isn’t fair. However, litigation funding can help solve that problem by providing financial support for your case. There is no need to view a settlement as the best you can get against these large corporations anymore. You should not settle your case for anything less than it is worth, especially if you can get the financial backing to better prepare for and analyze your case for trial through these third-party litigation funding companies.

Less risk than other financing options

The non-recourse transactions result in less financial worry. The contingency on the money advance means that both plaintiffs and firms take little risk outside of paying interest if they win. Even those who have the financial ability to try a case can feel at ease with this low-risk option. Many firms have the money to try the case but are not willing to risk that large sum of money on the outcome, especially now that money is becoming increasingly tighter for even the largest law firms due to COVID-19 and the suspension of the justice system. If the litigation funding company assesses the case and provides an advance of cash, then the risk is no longer on the firm but instead the litigation funding company.

Gain an independent assessment of your case

In order for a litigation funding company to support your case, they have to conduct their own internal assessment based on the claims and the experience of the litigation funders counsel. Litigation funding companies will independently assess your case to make sure the funding is in the best interests of both your firm, your plaintiff, and their company. These companies are not new to the game. Many times they have teams of veteran trial attorneys that go into detail as to why you have a strong case and why their investment is safe if they fund litigation you. The results of this assessment can give you valuable insights into how strong your case is, why it is strong, and whether going to trial is in your best interest.

Build the strongest possible case

With financial backing from a litigation funding company, you are able to afford everything needed to prepare the strongest case possible. You can hire consulting companies to do the research needed to fully assess all issues in your case as well as hire the witnesses needed to successfully sway the jury and win your case. Preparing a case for trial is not cheap, but any opportunity to strengthen your case should be taken if financially possible. Funding from these companies can help you afford these services that help you gain an edge against the defense.

How Many Litigation Funding Companies Are There?

There are over 50 litigation funding companies in the United States and that number is growing every day. A handful of publicly-traded litigation funding firms are being highlighted through media and news sources, but there are many smaller companies with more specialized funding available. These companies all compete with each other and obtaining multiple quotes and assessments can be very beneficial to you and your firm. You will have to shop around to find the best bang-for-your-buck. Each company may offer different amounts of advances, but make sure that you understand the amount of money you should be taking rather than the amount of money you can be taking as an advance.

How to Choose the Right Company

With dozens of third-party litigation expenses funding companies in the United States, where do you even start? Well, it all depends on your type of case. The much larger, publicly traded companies can have minimum financing amounts of 3, 4, or even 5 million dollars. To many firms, this may be far too much money for their case. Some smaller litigation funding usa do not have a minimum but instead have a maximum amount such as $500,000 or $1 million. That being said, shopping around is of the utmost importance when looking for litigation financing. These companies only care about the possible payout of your case and the likelihood you win. They are not going to do background or credit checks. Their offerings are specific to your exact case meaning that you need to find the company that fits your case best.

ABA Third-Party Funding Best Practices

Attorneys and the American Bar Association (ABA) have been skeptical of third-party litigation funding companies. They worry that these companies take advantage of smaller firms who are struggling or simply gouging firms with high-interest rates. However, that does not seem to be the case if, like with any loan or cash advance, you do your homework. In August of 2020, the American Bar Association adjusted its best practices for obtaining financial support from third-party funding companies.

- The transaction needs to be done in writing.

- The contingency or non-recourse nature of the funding, how the funding company is compensated, who is responsible for paying the funding company, and when and where that payment is coming from all need to be written out clearly.

- The client should retain all control of the litigation finance and not the funding company.

- Attorneys should remain cautious in making case-related reports or predictions.

How Jury Analyst Can Help

Our research can be a game-changer in many cases. It gives you valuable insights into arguments’ wording, theme development, voir dire topics, and even tailored jury selection. We have a team of psychologists and behavioral specialists who have developed metrics to assess the strength of your case and its weaknesses. Jury Analyst works with many trusted litigation funding companies. You can utilize our expert services with no up-front or out-of-pocket litigation costs/commercial litigation expenses to your client or firm. Your case can be assessed and funds available in as little as 24 hours, without a huge paperwork hassle.